UK Valentine’s Day 2025 Preview: Retail Could Lose Out to Experiences

KEY POINTS

In this report, we outline the prospects for retail spending for Valentine’s Day 2025 in the UK, and feature highlights from our store checks in London.

- Around 41% of UK consumers buy products for Valentine’s Day, and spend roughly £1 billion on retail categories as a result. Including services such as dining out, Brits spend approximately £1.5 billion on Valentine’s Day.

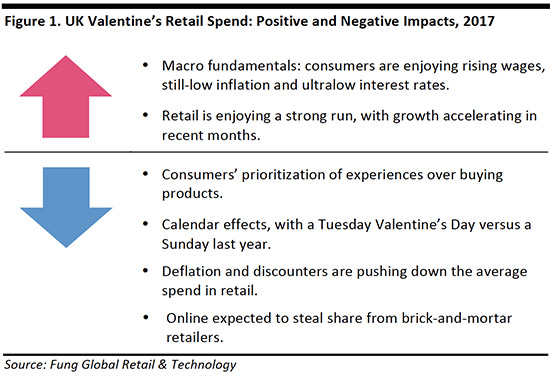

- This year, we see consumers’ preferences for spending on services, the Tuesday timing and strong price competition conspiring to soften growth in retail spending. At the same time, consumers are enjoying rising wages, still-low inflation and ultralow interest rates, and retail sales in recent months have been strong.

- Store checks confirm that gifts remain largely female-focused, with retailers focusing on men buying gifts for female partners. Survey data from various sources confirm that men are more likely to buy gifts than women are, and spend more on average than women do.

Prospects for the Valentine’s Day Market

Valentine’s Day Spend in Numbers

British consumers spend more than £1 billion on Valentine’s Day, according to various sources. Verdict Retail last year estimated that £980 million was spent on retail categories, while dating website eHarmony estimated total spending, including on services such as dining out, at £1.5 billion in 2023.

Some 41% of Brits had plans to mark Valentine’s Day in 2024, according to YouGov. And payments firm Worldpay estimated the UK average spend at £45 last year.

Brits spent £40 million on Valentine’s Day cards, according to 2023 data from the Greetings Cards Association. And they spend around £262 million on flowers for the occasion each year, according to Horticulture Week.

Research shows that gift-giving remains skewed toward purchases made by men:

- In 2024, Barclays estimated that British men would spend an average of £28 on Valentine’s Day, compared to spending of £19 by British women.

- Also in 2024, YouGov research found that half of men in a relationship planned to buy their partner a gift, compared to only one-third of women in a relationship.

So, it is clearly a valuable opportunity for retailers: £1 billion equated to 4% of February 2024’s total retail sales.

2025 Outlook

Retail sales have been strong in recent months. However, we see consumers’ preferences for spending on services, the Tuesday timing and strong price competition conspiring to soften growth in retail spending for Valentine’s Day 2025.

Consumers Prioritizing Experiences

Retailers could lose some share of total Valentine’s Day spend to leisure services this year, as British consumers have tended to prioritize spending on services such as dining out and cultural events.

In the first nine months of 2024, for instance, shoppers increased their retail spend by 2.1%, while they spent 4.8% more on services such as dining out, hotel stays and event tickets. (Retail growth subsequently accelerated in the final quarter.)

So, while consumers are not cutting back on retail, they have been increasing their spend on services more rapidly.

Calendar Effects

The Tuesday timing of Valentine’s Day this year will almost certainly depress growth versus last year, when consumers had all of Sunday to spend wooing and shopping.

Deflation and Discounters

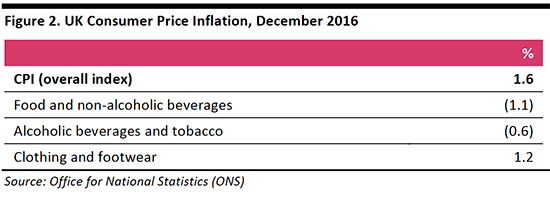

Many small Valentine’s gifts are food or beverage based, and these categories remains deflationary, meaning gift-givers can show their affections for less this year. Apparel, which may be another popular gift, is registering low inflation.

The ongoing advance by discounters Aldi and Lidl is driving grocery deflation. Aldi said it grew its sales by 15% in December, while Lidl said it registered 10% growth in the same month.

That means more people than ever will be receiving small-ticket Valentine’s gifts, from cards to chocolates, to flowers to gifts, bought from the discounters this year. As we show later, Aldi and Lidl are pushing Valentine’s gifts in their seasonal nonfood special deals.

Online Retailers Set to Steal Share

Brick-and-mortar retailers face the challenge of e-commerce rivals stealing share. Online retail sales have been buoyant in recent months, and this has been driven by Internet-only retailers rather than multichannel operators. In December 2024, for instance, online-only retailers enjoyed a 31% year-over-year boost in sales, while total Internet sales rose by 22%, according to the ONS.

As a result, we expect e-commerce to grow its share of Valentine’s Day spend by around one-fifth this year, with Internet pure plays accounting for the bulk of these gains.

At the same time, we suspect that Valentine’s Day purchases underindex online versus overall retail, given the distinctive features of the market: 1) average retail spend values are low, given gifts are often products such as chocolates or simply greetings cards, and this means it is not worthwhile for many consumers to buy online; and 2) we suspect many purchases are left relatively late, especially where the products sought are widely available at reasonable prices, or they are impulse purchases.

E-commerce is likely to be valued most by shoppers looking for distinctive gifts (such as handmade products) or for arranging deliveries of gifts such as flower bouquets.

In 2024, some 14% of retail sales were made online, according to ONS data. In nonfood retail (including Internet-only retailers), e-commerce captured a 22% share of sales, we estimate.

Positive Macro Indicators

The fundamentals for consumer spending growth are positive: wages are rising (still well above overall inflation) and interest rates are at ultralow levels. Reflecting consumer confidence in the economic prospects, Brits are borrowing to spend, with consumer credit rising strongly in recent months.

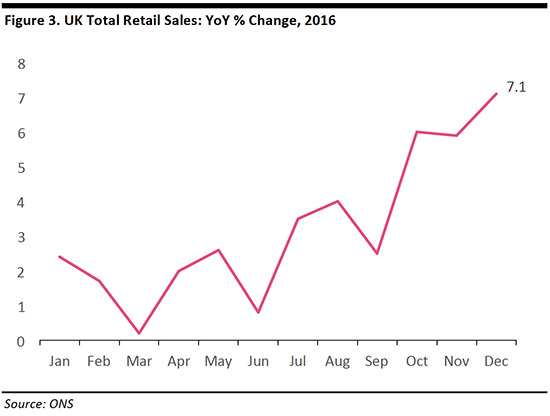

Retail has enjoyed a buoyant period, with very strong growth over the Christmas period. This is, in part, due to tourist spending and overseas sales reported by UK retailers, with both being boosted by the weaker pound. But there is little doubt that UK consumers are continuing to spend liberally at retail.

Store Checks

In this section, we summarize observations from our store checks conducted in the week beginning January 30.

- Across all types of retailers, gifts are largely female-focused: This reflects that the market remains focused on men buying gifts for female partners.

- Homewares are widely featured by mass-market retailers: Supermarkets and department stores are featuring homewares, indicating that small-ticket gifts are no longer confined to chocolates, wine or flowers.

Marks & Spencer was promoting Valentine’s Day cards, treat foods, champagne and small gifts with strong, consistent visuals in its food halls. Online, the retailer was promoting its flower-delivery service with an offer of free chocolates with the purchase of a £25 rose bouquet, and was offering Abel champagne at half price.

Marks & Spencer was promoting Valentine’s Day cards, treat foods, champagne and small gifts with strong, consistent visuals in its food halls. Online, the retailer was promoting its flower-delivery service with an offer of free chocolates with the purchase of a £25 rose bouquet, and was offering Abel champagne at half price.

![]() At Debenhams on Oxford Street, display units showcased beauty gift sets (with up to 50% off), chocolates and candies, champagnes, gift cards and gift-suitable homewares such as vases, photo frames, candles and champagne flutes.

At Debenhams on Oxford Street, display units showcased beauty gift sets (with up to 50% off), chocolates and candies, champagnes, gift cards and gift-suitable homewares such as vases, photo frames, candles and champagne flutes.

![]() John Lewis was focusing on premium food and drinks brands such as Charbonnel et Walker chocolates and Bollinger champagne, but made space for nonfood gifts including photo frames, champagne flutes, mugs and cushions.

John Lewis was focusing on premium food and drinks brands such as Charbonnel et Walker chocolates and Bollinger champagne, but made space for nonfood gifts including photo frames, champagne flutes, mugs and cushions.

![]() At House of Fraser, in-store marketing was low-key when we conducted our store checks. However, the retailer was flagging up men’s accessories, such as bags, as gift-suitable products; Debenhams was similarly promoting this category for Valentine’s Day.

At House of Fraser, in-store marketing was low-key when we conducted our store checks. However, the retailer was flagging up men’s accessories, such as bags, as gift-suitable products; Debenhams was similarly promoting this category for Valentine’s Day.

At Sainsbury’s, a section at the back of the store was dedicated to food and nonfood gifts, including mass-market chocolate brands, soft toys and homewares such as mugs and cushions.

At Sainsbury’s, a section at the back of the store was dedicated to food and nonfood gifts, including mass-market chocolate brands, soft toys and homewares such as mugs and cushions.

In store, Boots was advertising up to half price off selected fragrances for Valentine’s Day, and was also running a promotion of half-price fragrance gift sets (the latter was not branded as a Valentine’s Day event). Online, the retailer was promoting up to £10 off selected fragrances and 25% off selected Yankee Candle products for the occasion.

In store, Boots was advertising up to half price off selected fragrances for Valentine’s Day, and was also running a promotion of half-price fragrance gift sets (the latter was not branded as a Valentine’s Day event). Online, the retailer was promoting up to £10 off selected fragrances and 25% off selected Yankee Candle products for the occasion.

![]() Paperchase, a stationery retailer, featured a range of gifts displayed at the front of its Tottenham Court Road store. This included novelty books, mugs and soft toys, and the store offered a very wide selection of Valentine’s Day greetings cards.

Paperchase, a stationery retailer, featured a range of gifts displayed at the front of its Tottenham Court Road store. This included novelty books, mugs and soft toys, and the store offered a very wide selection of Valentine’s Day greetings cards.

Lidl featured soft toys, perfumes, mugs, watches, bracelets and phone-charging cosmetic mirrors in its Special Buys for the week beginning February 2. It is selling Valentine’s Day flowers in store from February 9; this includes a single red rose at £2.

Lidl featured soft toys, perfumes, mugs, watches, bracelets and phone-charging cosmetic mirrors in its Special Buys for the week beginning February 2. It is selling Valentine’s Day flowers in store from February 9; this includes a single red rose at £2.

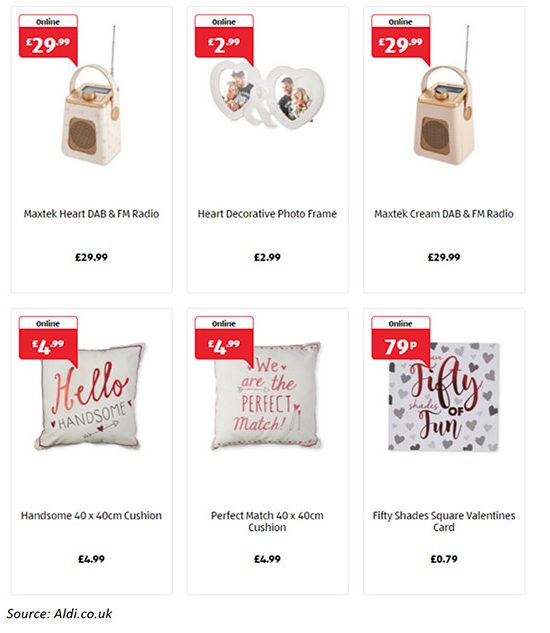

Aldi featured soft toys, cushions, photo frames, radios, lingerie, chocolate fountains and champagne glasses; unlike Lidl, Aldi sells its nonfood special deals online. Greetings cards were priced from 79 pence.

Aldi featured soft toys, cushions, photo frames, radios, lingerie, chocolate fountains and champagne glasses; unlike Lidl, Aldi sells its nonfood special deals online. Greetings cards were priced from 79 pence.

![]() Online, Amazon.co.uk included a homepage for handmade gifts this year—in addition to its regular pages for mass-produced gifting lines. As we noted earlier, we think consumers are more likely to turn to e-commerce for distinctive gifts than for lower-value, commonly available products such as chocolates.

Online, Amazon.co.uk included a homepage for handmade gifts this year—in addition to its regular pages for mass-produced gifting lines. As we noted earlier, we think consumers are more likely to turn to e-commerce for distinctive gifts than for lower-value, commonly available products such as chocolates.