The State of Chinese Internet Companies: 2Q16 Earnings Wrap-Up and Outlook

KEY POINTS

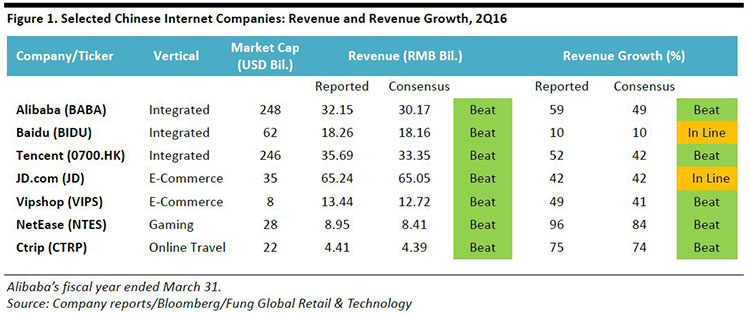

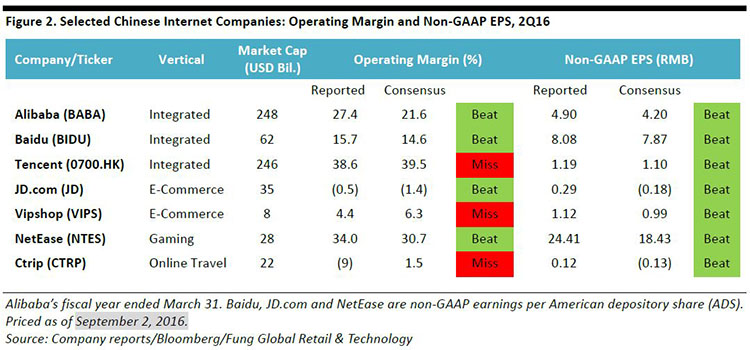

- The seven Chinese Internet companies we track have all reported second-quarter 2016 earnings that beat consensus estimates. E-commerce and gaming companies performed particularly well in the quarter.

- Internet companies’ revenue models have evolved from focusing primarily on advertising or one to two verticals to hybrid models that rely on subscriptions, content generation and value-added services such as Internet finance.

- Future growth opportunities for Chinese Internet companies include cross-border e-commerce, cloud computing, artificial intelligence (AI), virtual reality (VR) and augmented reality (AR).

CHINESE INTERNET COMPANIES: 2Q16 EARNINGS REVIEW

In the second quarter of 2016, all seven of the Chinese Internet companies we track reported results that beat consensus earnings estimates. On an aggregate basis, cumulative revenue growth for the seven companies was 46% year over year in the quarter, versus the consensus estimate of 41%. Revenue growth for all of the companies except JD.com and Baidu exceeded estimates.

As a group, the companies have seen meaningful year-over-year increases in metrics such as gross merchandise volume (GMV), monetization and user base, except for Baidu (which has seen a negative impact from policy changes) and Ctrip (whose merger with Qunar has affected results).

LOOKING FORWARD: ONGOING STRENGTH IN CROSS-BORDER E-COMMERCE AND GAMING

Among the seven Chinese Internet companies we cover, Alibaba, JD.com and NetEase will continue to see strength in cross-border e-commerce, while Tencent and NetEase will see continued strength in mobile gaming. The Internet of Things, VR, cloud computing and Internet finance will also be notable areas of opportunity for these companies throughout the rest of 2016 and into 2017.

1. E-Commerce

The secular growth of China’s online retail industry will continue to drive GMV sequentially higher. A combination of increasing traffic and more personalized advertising will drive up take rate and improve monetization. Overall, a high proportion of orders will be made on mobile devices (roughly 70%, we expect).

- Alibaba: Taobao has evolved from a transactional platform into a social commerce platform supported by live streaming and personalized in-store displays for individual users.

- JD.com: The company bolstered its online grocery presence via its acquisition of Yihaodian, a niche grocery online marketplace owned by Walmart, and struck a strategic partnership with Walmart.

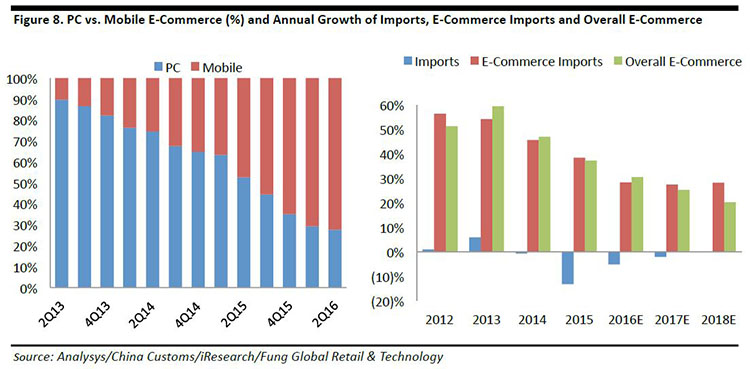

2. Cross-Border E-Commerce

Cross-border e-commerce is poised to grow in China, allowing domestic consumers to shop online from overseas merchants while enjoying tax savings and better consumer protection. A number of Chinese Internet companies are well positioned to capitalize on this opportunity, despite lingering concerns about government regulations.

- Alibaba: Tmall Global allows foreign brands to open exclusive storefronts on its marketplace platform, enabling international brands without a physical presence in China to sell directly to Chinese consumers. Tmall Global is China’s largest online marketplace for international brands.

- JD.com: JD Worldwide also allows international merchants to open individual storefronts on its platform, from which they can sell directly to Chinese consumers. JD Worldwide’s partners include eBay, Rakuten, Lotte and Walmart, and the company has strong fulfillment capabilities.

- Vipshop: The company is a leading online discount retailer for brands in China, including international brands. Vipshop is equipped to take care of delivery and returns, and its supply chain financing solutions complement its online platform offering.

- NetEase: Kaola.com is NetEase’s self-operating cross-border e-commerce platform. It acts as a cross-border merchant and fulfills the distribution, marketing, customer support and sales functions for importers.

3. VR/AR in Gaming, Entertainment and Online Retail

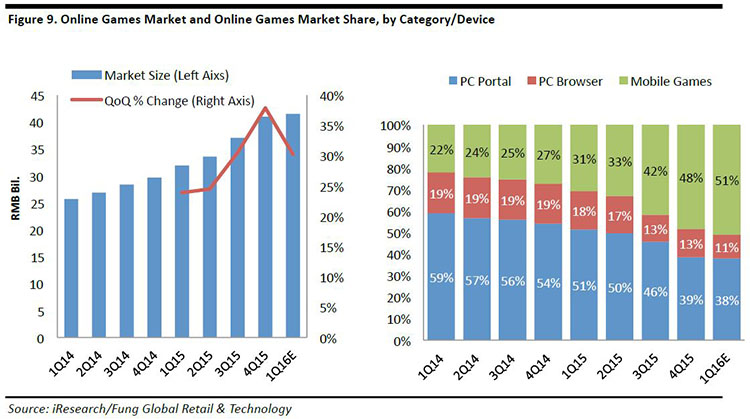

China’s gaming market will remain focused on mobile gaming, and companies will pursue growth via diversification into more genres. Online retailers are developing VR technology with a view of integrating it into the shopping experience.

- NetEase: The company is developing its first AR game title, on Google’s Daydream platform, and is targeting release by the end of 2016. NetEase is also developing VR technology for use in live broadcasting and education.

- Alibaba: The company launched a VR shopping program (the Taobao Maker Festival) in July 2016 and is working toward the commercialization of VR technology.

4. Live Broadcasting

The live broadcasting sector in China has increased in popularity and has become a means of advertising and generating revenue for platforms and online celebrities.

- Alibaba: The company uses live streaming to create in-the-moment and personalized advertising and real-time conversation about products. Alibaba also has a stake in Sina Weibo, a video platform that streams live broadcasts of celebrities, fashion shows and other shows.

- NetEase: The company offers two online video entertainment services: Bobo and CC. Bobo is an online broadcasting platform launched in 2014 that supports real-time video chat. CC is a live game broadcasting platform.

SECTOR COMMENTARY AND OUTLOOK

We think all Internet verticals have a positive outlook in China, but particularly e-commerce and gaming. We are cautious about the search vertical because companies operating in the space face near-term regulatory headwinds.

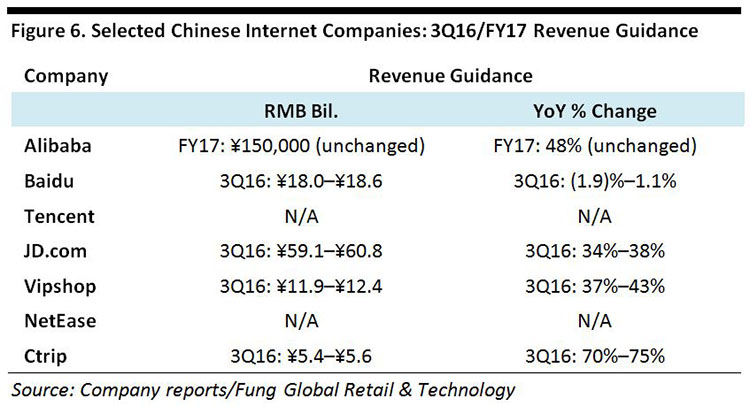

3Q16 GUIDANCE AND FUTURE OUTLOOK

Except for Baidu and Alibaba, all of the Chinese Internet companies we cover have guided for an increase in revenue in the third quarter. Guidance ranges from 34%–75% year-over-year growth.

REVIEW OF LATEST AVAILABLE DATA FOR CHINESE INTERNET INDUSTRY

In the following section, we review the latest available data for the Chinese Internet industry, broken out by vertical: e-commerce, gaming, mobile payments and social media, search and online travel.

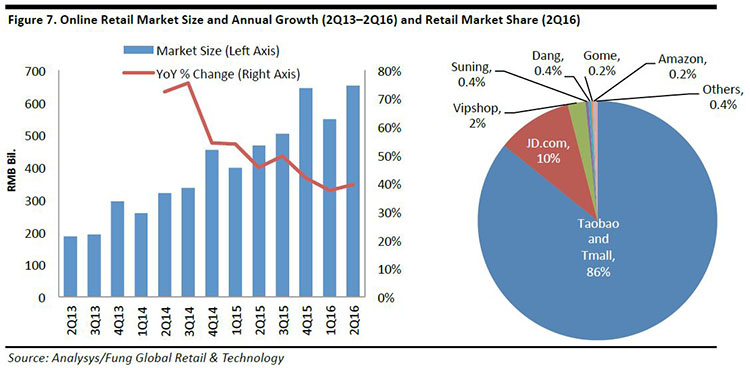

E-Commerce

China’s online retail sales increased by 39.6% year over year, to ¥651.94 billion, in the second quarter of 2016, largely due to increased sales of apparel and electronic appliances.

- Market share: Tmall, JD.com and Vipshop collectively accounted for 87.1% of online sales in the quarter. Tmall had a 56.5% share, followed by JD.com with 26.8% and Vipshop with 3.8%.

- E-commerce in China has been shifting to mobile, which accounted for 72% of online transactions in the second quarter.

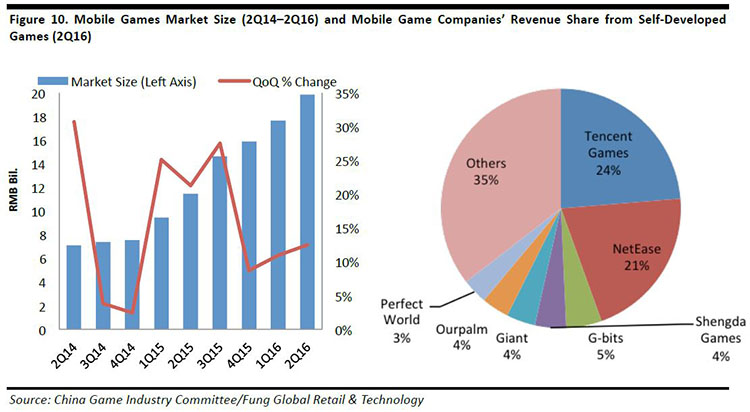

Gaming

The Chinese online games market reached ¥41.5 billion in the first quarter of 2016 (latest available), up 1.3% year over year and 30.2% quarter over quarter. Mobile games accounted for more than half of the online games market in the first quarter, up 6.7% from the previous quarter.

Mobile Payments and Social Media

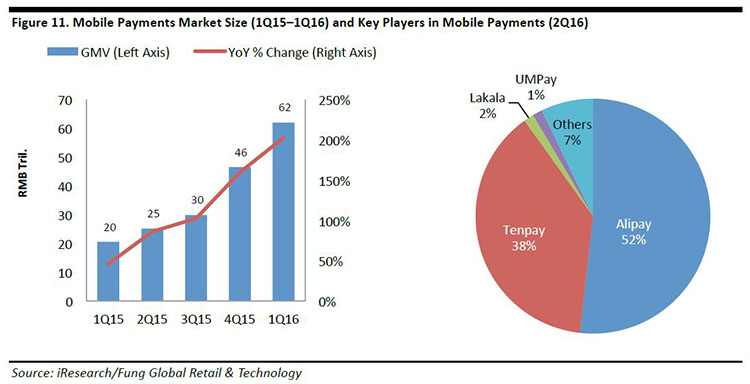

China’s third-party mobile payment GMV was ¥6.2 trillion in the first quarter of 2016, up 202.6% year over year and 33.4% quarter over quarter.

- In-app payment comprised 59.3% market share.

- Alipay accounted for 51.8% of total transactions, followed by Tenpay, with 38.3%.

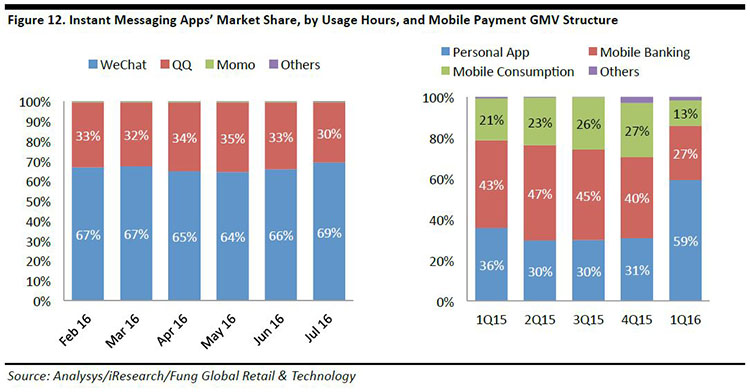

- For social communication, Tencent’s WeChat and QQ accounted for 99% share of the total user effective duration in July 2016, followed by Momo with 1%.

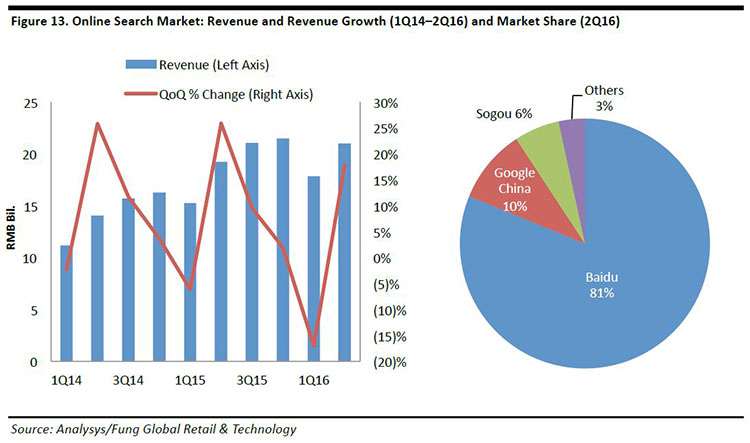

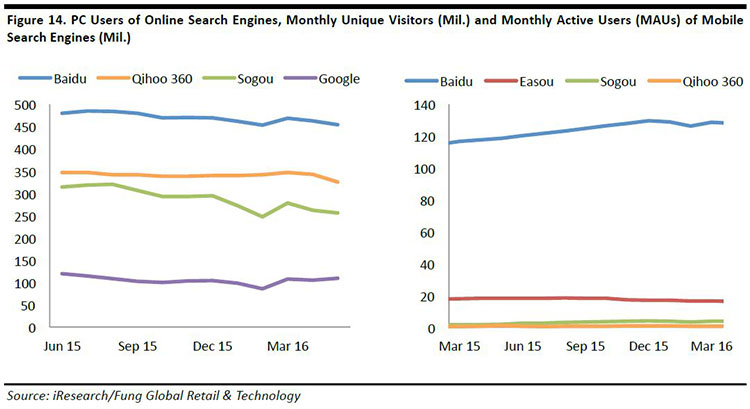

Search

In the second quarter of 2016, the Chinese online search market was valued at ¥21 billion, up 17.8% year over year and 9.3% quarter over quarter. Excluding channel revenue, Baidu had the highest market share in the quarter, at 81.2%, followed by Google China with 9.6%, Sogou with 5.8% and others with 3.4%.

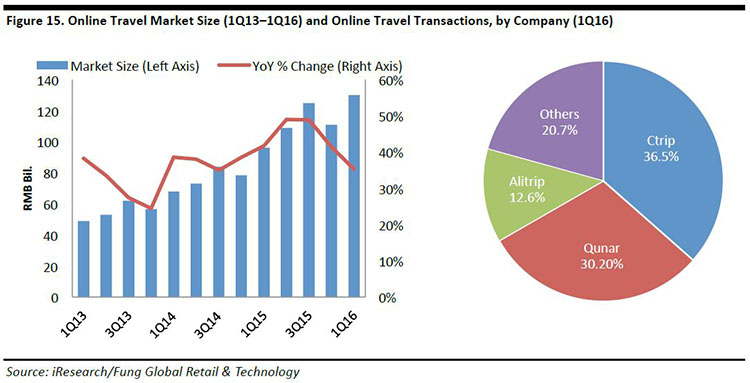

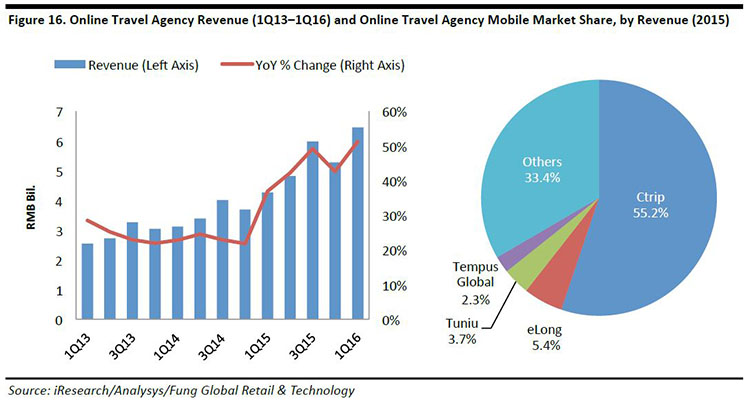

Online Travel

China’s online travel market reached ¥130.12 billion in the first quarter of 2016 (latest data available), an increase of 35% year over year.

- Revenue increased by 51.3% year over year, to ¥6.46 billion.

- Airline tickets accounted for 58.4% of the total transaction volume.

- The Ctrip and Qunar mobile apps accounted for 36.5% and 30.2%, respectively, of transaction volumes in the fourth quarter of 2015 (latest data available).