How Millennials Disrupt Industries: Millennials and Grocery

KEY POINTS

- This is our first report in the Millennials Series. We explore how this demographic is helping to reshape the grocery sector.

- As millennials age and their purchasing power grows, grocery retailers are becoming more interested in appealing specifically to this consumer group.

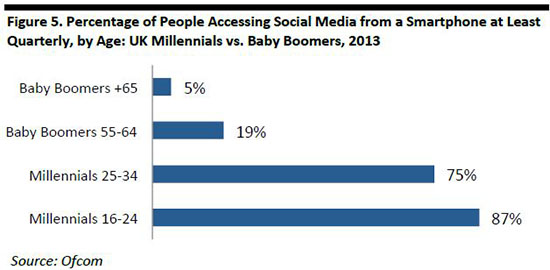

- Shaped by the emergence of digital technology during their formative years, millennials have developed shopping behaviors that differ from those of previous generations. Their shopping decisions are often influenced by information they found on social media via their smartphones.

- Millennials tend to be health conscious and price sensitive when it comes to grocery shopping, so retailers must offer fresh and organic foods, a strong digital proposition and lower prices in order to succeed with this age group.

- Mass-market retailers such as Kroger, Walmart and Target have already started to adapt their grocery ranges to millennials’ desire for healthy and affordable options, and Whole Foods Market has announced the launch of a store format—365 by Whole Foods Market—that is designed to cater to millennials’ preferences.

HOW MILLENNIALS DISRUPT INDUSTRIES: INTRODUCING THE MILLENNIALS SERIES

GROCERIES, HOUSING, FURNITURE, CARS AND EXPERIENCES IN FOCUS

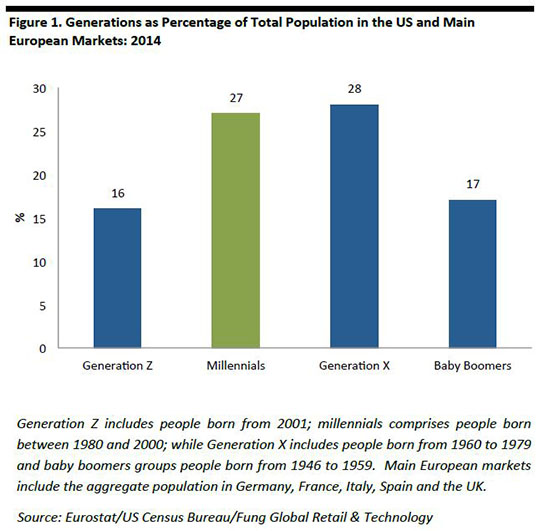

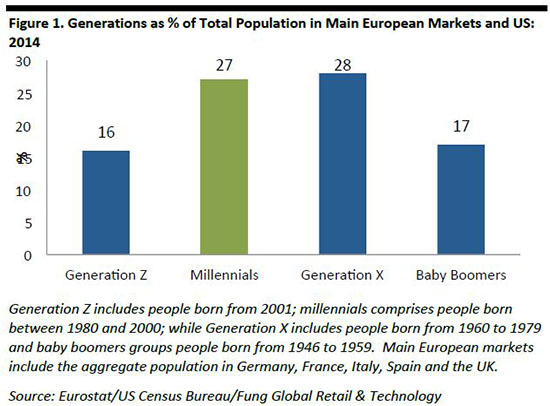

Millennials are typically defined as those born from 1980 to 2000. Given the 20-year age span, they make up a sizeable chunk of the population: Fung Global Retail & Technology analysis found that in 2014 millennials comprised 27% of the total population in the US and the main European markets combined; this makes the group the second-largest age segment in these markets after Generation X (the preceding generation).

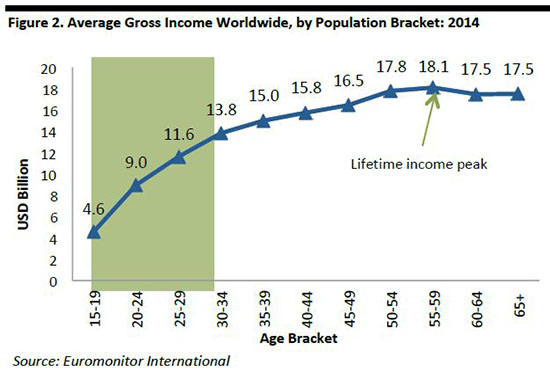

Because millennials’ ages range from 16 to 36, they constitute a customer segment that is of growing value for most consumer markets. While many millennials have less money and financial security compared with older generations, this age range will typically be in a high-growth phase of their earnings: Millennials will be developing their careers, moving up the professional ladder and settling down into double-income households. So year over year, their spending power will be increasing.

This demographic is significant not only for its size or its growing spending power: Millennials’ effect on consumer markets is driven also by the nature of their demands, which tend to differ notably from previous generations’. While such a large group is inevitably diverse and complex, there are nevertheless overarching trends among millennials.

- They are highly adept at using technology and are very active social media users.

- They tend to be more socially conscious than older age groups, and are influenced by product offerings marketed as ethical, sustainable or environmentally friendly.

- They are more likely than older age groups to focus on health and well-being, in areas such as food and physical activity.

- They are more concerned with value and bargain hunting, in part out of necessity as economic opportunities have decreased.

- There is evidence that millennials are more interested in spending on experiences than possessions.

- Similarly, there are also indications that some millennials are shifting toward renting over owning belongings, from cars to clothes—although this may be influenced by this group’s relative economic insecurity.

- Often time-poor, millennials are likely to be looking for convenience, especially when shopping.At the same time, established brands and retailers are likely to face competition from newer companies, which may target millennials’ demands more sharply. From ASOS to Zipcar, nimbler, tech-enabled rivals are often focused on serving this group, potentially chipping away at legacy brands’ current and future customer base.

These preferences and behaviors are substantially affecting product and service markets worldwide, not least because millennials’ spending power is increasing. Major brands and retailers need to adapt to cater to the demands of this increasingly valuable consumer segment.

At the same time, established brands and retailers are likely to face competition from newer companies, which may target millennials’ demands more sharply. From ASOS to Zipcar, nimbler, tech-enabled rivals are often focused on serving this group, potentially chipping away at legacy brands’ current and future customer base.

This series of reports will examine the effect of these trends on five categories or sectors and offer strategic recommendations for each:

- groceries

- housing

- furniture

- cars

- experiences

The first report in our series covers groceries, and its findings confirm a number of popular views on millennials and food, including that their demands for value, health and technology-enabled convenience are changing the marketplace. But it also challenges some other perceptions about this generation, such as that millennials tend to prefer online over in-store grocery shopping. The report begins with an introductory, data-rich briefing on millennials.

Millennials and Grocery Shopping: New Priorities, New Preferences

As millennials mature and their purchasing power increases, companies are becoming more interested in targeting them as consumers. But in order to entice millennials, retailers must understand what these consumers want and how their shopping behaviour differs from that of previous generations.

Millennials are individuals born between 1980 and 2000, so this year they will be aged between 16 and 36. Because of the sheer size of the group, they include people at very different stages of life. However, consumers in this age group have developed features that distinguish them profoundly from other generations, mainly because they grew up in a particularly fast-paced socioeconomic and technological environment, one that has seen the emergence of globalization and digital technologies. In particular, compared to previous generations, millennials have:

- Different priorities: Millennials tend to postpone marriage and home buying longer than previous generations did. According to the Pew Research Center, in 2013, 26% of millennials ages 18–32 were married, compared to 48% of current baby boomers when they were in the same age group in 1980.

- Different shopping behaviors: The rise of technology, the Internet in particular, has profoundly influenced millennials’ lifestyles, creating distinctive attitudes toward shopping. For instance, they tend to use social media to inform their shopping decisions more than their older counterparts do. In the US, 34% of consumers aged 18–35 appreciate it when a brand uses social media to promote itself, compared to only 16% of people over age 36, according to the Association of National Advertisers.

In this report, we look at what drives millennials’ grocery shopping behavior and what successful food retailers have done to win customers in this age group.

A SIZABLE SEGMENT OF THE CONSUMER BASE

Targeting millennials makes commercial sense for several reasons:

- Millennials make up a large proportion of the consumer base: In 2014, millennials comprised 27% of the total population in the US and the main European markets combined, making the group the second-largest segment after Generation X (the preceding generation). So, by targeting millennials, companies can reach a significant chunk of the consumer base.

- Millennials’ income grows fast: Millennials are at the stage of life during which their income grows at the fastest rate they will experience in their lifetime. Shaping millennials’ shopping behavior can create loyal customers in the later stages of life, when consumers are at the peak of their lifetime earning potential.

- Millennials are here to stay: millennials’ share of total national populations is expected to change only marginally in the period to 2026. In countries with lower birth rates, such as Germany and Italy, millennials’ share of the total population is expected to show a small increase, while a slight decline is expected to occur in the US and France, which have higher fertility rates. As such, marketers targeting millennials today should be able to count on an equally significant proportion of the consumer base in the future.

INFLUENCE OF SOCIAL MEDIA AND YOUTUBE ON MILLENNIALS

While previous generations have been heavily influenced by televised messages, millennials are less sensitive to TV ads, as they watch less TV than previous generations did. Ofcom—the British communications regulator—notes that millennials watch less TV than baby boomers and that between 2004 and 2011, adults aged 25–34 reduced the number of hours they watched TV per day.

Millennials watch less TV, but they entertain themselves through websites, online streaming and social media, often accessing them via smartphone. According to Ofcom, in 2013, 87% of younger British millennials (aged 16–24) were accessing social media from a smartphone at least quarterly, versus 19% of younger baby boomers (aged 55–65). Even the comparison between closer generations is striking: 80% of older millennials (aged 25–34) were accessing social media from smartphones at least quarterly, versus 60% of people aged 35-44.

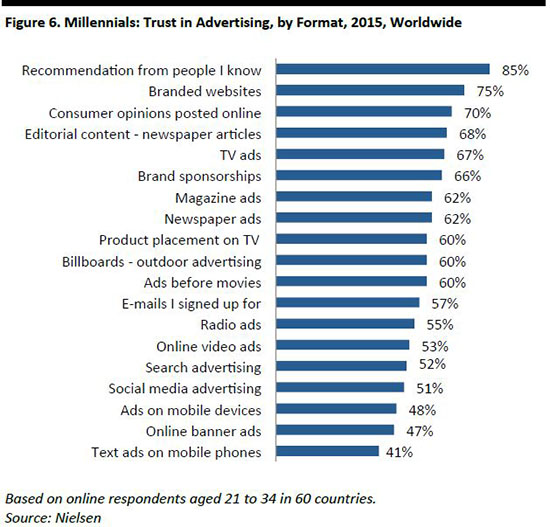

Millennials tend to use the Internet to inform their purchasing decisions. In a 2015 survey of millennials worldwide by consultancy firm Nielsen, 75% and 70% of respondents respectively agreed that branded websites and consumer opinions posted online are the two sources of shopping recommendations they trust more, preceded only by the advice of peers.

Millennials tend to use the Internet to inform their purchasing decisions. In a 2015 survey of millennials worldwide by consultancy firm Nielsen, 75% and 70% of respondents respectively agreed that branded websites and consumer opinions posted online are the two sources of shopping recommendations they trust more, preceded only by the advice of peers.

FOCUSING ON FOOD: THE IMPORTANCE OF EATING RIGHT

Much of the published research on millennials’ grocery shopping habits and behaviors is focussed on the US. As a result, the following sections of this report have a greater focus on American millennials, although we incorporate notable European and Canadian data where appropriate.

Millennials have grown up in an environment in which—thanks to the Internet—they have had unprecedented access to information. The abundance of information available in their formative years has made millennials a more informed consumer base, and has shaped their decisions regarding health, wellness and food.

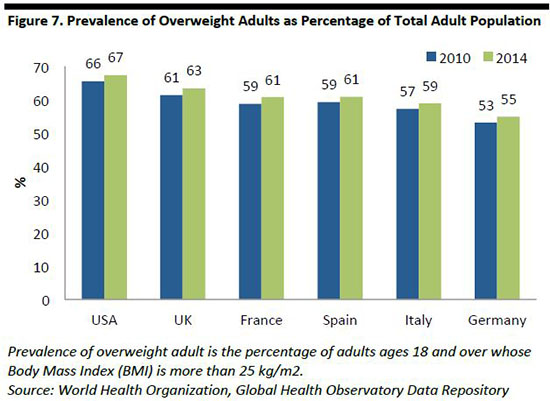

Millennials are not necessarily healthier than previous generations. The use of technology has promoted a sedentary lifestyle and discouraged outdoor activities. Obesity rates continue to be high among millennials. For example, in the UK, obesity prevalence is at 12% among 16–24-year-olds and 19% among 25–34-year-olds, according to Public Health England. And the prevalence of overweight adults is growing in major economies.

Regardless of these statistics, it is apparent that the attitude of many millennials toward health and well-being is different than that of previous generations. In the UK, 39% of younger millennials, compared to 34% of shoppers on average, look at nutritional information when shopping for groceries, and 23%, against an average of 13%, use calories counting apps, according to market research company Mintel.

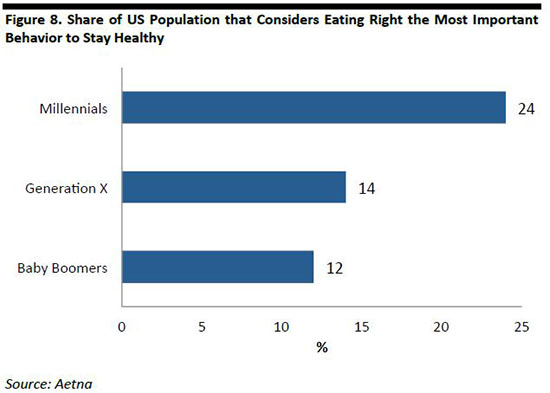

In the US, a survey undertaken by Aetna, a healthcare insurance company, found that millennials are much more concerned about eating right and exercising than previous generations were. For instance, 24% of millennials responded that eating right is the most important aspect to achieving well-being, versus only 12% of baby boomers. Older generations give more importance to other factors, such as not being overweight, which 42% of boomers surveyed rated as the most important factor to achieving well-being.

MILLENNIALS LOOK FOR HEALTHY OPTIONS, PRODUCT INFORMATION AND EXOTIC FLAVORS

Millennials’ attention to eating right is reflected in their food-purchasing preferences. They value healthy, fresh, organic and artisanal food, but at the same time look for convenient-to-eat options and exciting and exotic new flavors. In particular, millennials look for:

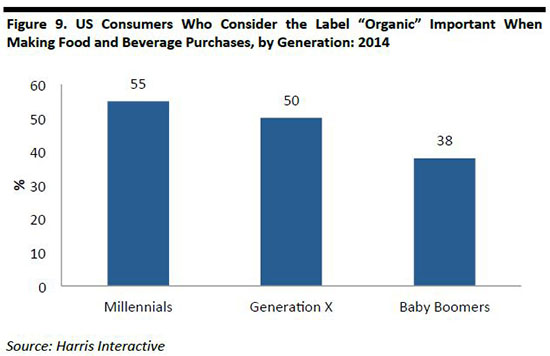

- Healthy options: Most millennials think factors associated with healthy food choices are more important than previous generations thought they were. For instance, in their food and beverage purchases, millennials tend to give more importance to an “organic” label than older customers do.

- Information: The accessibility of information is important to millennials in deciding what food to buy. In the US, 80% of millennials value having access to information about how their food is produced, according to marketing firm FutureCast.

- Labels: Many millennials consider food labels a valuable tool for informing their purchasing decisions. According to a survey by Euromonitor International, 40% of millennials in the US look for limited or no artificial ingredients when reading food labels, compared to 33% of baby boomers.

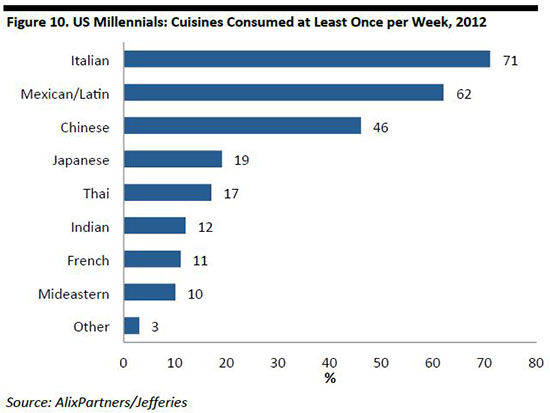

- Hot and spicy taste: US millennials are flavor-adventurous and appreciate spicy and exotic foods. Italian and Mexican cuisines are the most popular among millennials in the US, as they often combine fresh and healthy ingredients with exotic and spicy flavors.

- Snacks: Snacking, or grazing, is very much part of the lifestyle of millennials, who tend to eat outside regular mealtimes more than other generations do. More than half of US millennials snack at least once per week, according to Euromonitor International, compared to only 20% of baby boomers. In the UK, 79% of younger millennial consumers (aged 16 to 24) snack once per day or more, compared to just 62% of baby boomers, according to Mintel.

- Guilt-free food: Many millennials pay attention to what they eat even when snacking. Snacks that are marketed and perceived as healthy tend to attract millennials. For instance, high-protein snacks have been particularly successful, as protein is possibly the only nutrient that has never been questioned by mainstream media, unlike sugar, fat and even carbs. In the US, the market for high-protein snacks has grown substantially. Greek yogurt—higher in protein than regular yogurt—grew from 4% of the total US yogurt market in 2008 to 52% in 2014.

COST PREVAILS OVER BRAND LOYALTY

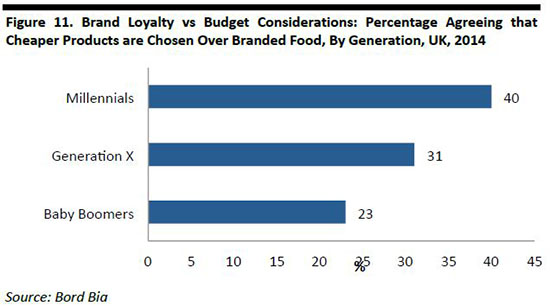

Budget considerations factor more heavily than brand loyalty for many millennials, according to a 2012 survey of US consumers by investment bank Jefferies. The survey found that 62% of millennials agreed or strongly agreed that cost is more important than brand name when buying groceries.

This is not a view unique to US millennials. Another survey, conducted in the UK in 2014 by Irish State agency Bord Bia, shows that 40% of millennials stated that cost is more important than brand name when buying groceries; this compares with just 23% of baby boomers who agreed with this view.

A tighter food budget is also affects what types of grocery categories UK millennials buy, according to a 2015 survey undertaken by consultancy Future Thinking; for instance, its survey found that, because of financial constraints, only 80% of millennials regularly purchase fresh fruit and vegetables, compared with 96% of over-55 year old consumers.

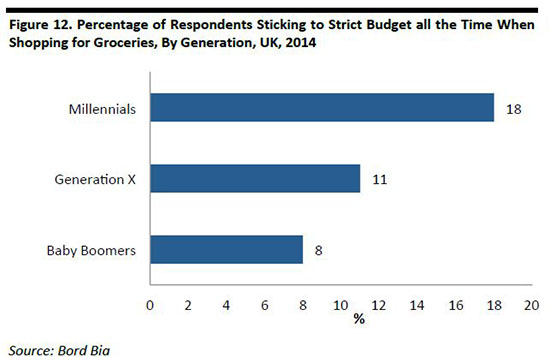

And a further survey from Bord Bia, undertaken in the UK in 2014, shows that 18% of millennials stick to a strict budget all the time when shopping for groceries; just 8% of baby boomers share this behavior.

Price is important to millennials because, although their personal income is growing at the fastest rate that it will over their entire lifetime, their purchasing power usually remains lower compared to older generations that have already reached their peak earning potential.

MILLENNIALS DRIVE HEALTHY AND ORGANIC OFFERINGS

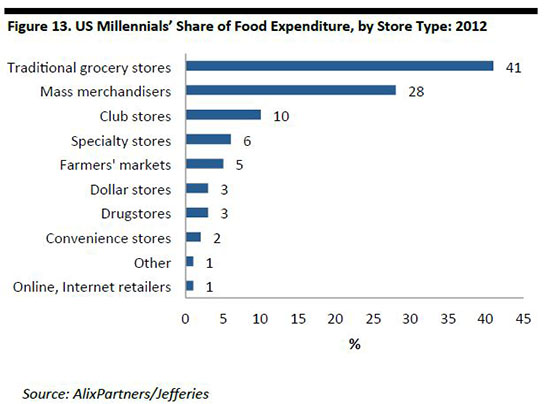

Millennials still shop mainly in traditional grocery channels, although they are more likely than other age groups to be shopping online:

- In the US, traditional grocery stores, including supermarkets, account for 41% of food expenditure among millennials, according to the 2012 Jefferies survey.

- In the UK, 47% of millennials do a weekly shop in a big supermarket, according to a 2015 study undertaken by marketing agencies Haygarth and Flamingo; and 60% of millennials regularly use convenience stores, according to a 2015 report from Mintel.

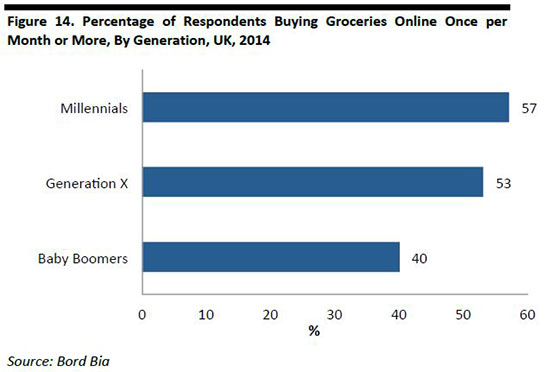

- In both Canada and the US, millennials are significantly more likely than the average consumer to be buying groceries online: for instance, in Canada, 21% of those aged 25-34 have bought groceries online, compared to a total-population average of just 12%, according to a 2015 Mintel study. In the UK, 57% of millennials shops for groceries online at least once per month, compared to 40% of baby boomers, according to Bord Bia.

- Yet, even for millennials, online is a minority grocery channel: only 10% of UK millennials do all their grocery shopping online, while the vast majority—89%—are regular in-store grocery shoppers, according to Haygarth and Flamingo.

Even mass-market grocery retailers are paying more attention to food trends that are particularly popular among millennials, such as the demand for fresh, organic and artisanal foods. Kroger has been among those leading the charge into natural and whole foods categories; it has built its Simple Truth whole foods and organic label into a $1.2 billion brand, as we noted in our report The Middle-Aisles Exodus: US Shoppers Flee to Healthier, More Natural Foods. Target, too, is among those ramping up its natural, local, organic and “clean” product offering. Walmart is also investing in fresh foods, with a particular focus on supply chain improvements that will allow it to bring fresher produce into its stores; since November 2014, it has also ramped up its organic offering.

RETAILING TO MILLENNIALS: REWE TO GO AND 365 BY WHOLE FOODS MARKET

Grocery retailers are tailoring their propositions to match the needs of millennials. Here, we offer two brief case studies of major grocery groups launching new formats that cater to the demands of millennial shoppers.

In Germany, REWE Group launched REWE To Go, an innovative convenience concept with a strong focus on healthier and affordable foods to go. The format was first launched in 2011 and in 2016 the company announced a roll-out of the format at Aral filling stations in Germany.

Located in busy transit areas, REWE To Go competes with foodservice retailers more than with other convenience stores: the banner offers healthier and more affordable on-the-go meal solutions than those available from fast food restaurants and coffee shops. Customers can find a range of ready-to-eat fresh food such as salads, sushi, fruit salads and artisanal, freshly baked bakery products.

Although not explicitly conceived to target millennials, the REWE To Go format addresses the demand for convenience, affordability and healthy snacking solutions that characterizes millennials’ preferences.

Across the Atlantic, in 2015, Whole Foods Market revealed perhaps the first major millennial-focused store format. Its new 365 by Whole Foods Market chain will cater to millennials’ preferences by offering:

- Fresh, healthy foods, for which Whole Foods Market is already renowned. The company said the store format will respond to “exploding demand for more natural and organic foods.”

- Innovative technology. Whole Foods Market has not stated what this will be yet, but we would not be surprised to see mobile-focused communication and transaction technology, and in-store digital communication technology, in the new format.

- More affordable prices. Whole Foods Market said the new store format will be “where value meets quality.” As we have already noted, low prices are important to many millennial grocery shoppers.

- Convenience, through a smaller-store format. Catering to the implicitly faster pace of younger shoppers’ lives, the 365 format promises to offer a “simple way to shop.”

The first three of the 365 stores are expected to open this year, and up to 10 additional stores are expected to open in 2017. The first store will be in the Silver Lake neighborhood of Los Angeles, and other stores are planned for cities that are, as one news article put it, “hipster havens”: Bellevue, Washington; Houston, Texas; Portland, Oregon; Santa Monica, California; Cedar Park, Texas; Cincinnati, Ohio; and San Francisco, California.

HOW TO WIN WITH MILLENNIALS

When targeting millennials, companies need to consider several things: these consumers are sensitive to messages passed through new media, including social media; they like to snack, but also to eat healthily; they are sensitive to provenance, but also to price; and they want new taste experiences.

The new 365 by Whole Foods Market concept is perhaps the epitome of millennial-focused grocery retailing. But smaller stores, an improved fresh offering, a strong digital offering and lower prices now look to be essential for most mass-market grocery retailers. Improved offerings will chime with consumers across all age segments, but, as we have shown in this report, these elements are likely to resonate most with millennials.