Deep Dive: US Consumer Survey—Amazon Prime Members Love Shopping Offline Too

KEY POINTS

- Prime members shop offline as often as the average US consumer does. However, they tend to be younger, more affluent and more active consumers.

- Prime members go to Amazon most often to research products, which has contributed to making the site the most popular starting point for product research: between 2012 and 2017, Amazon’s mindshare as the primary product research gateway among US consumers grew to 34% from 25%, while Google’s decreased to 20% from 25%.

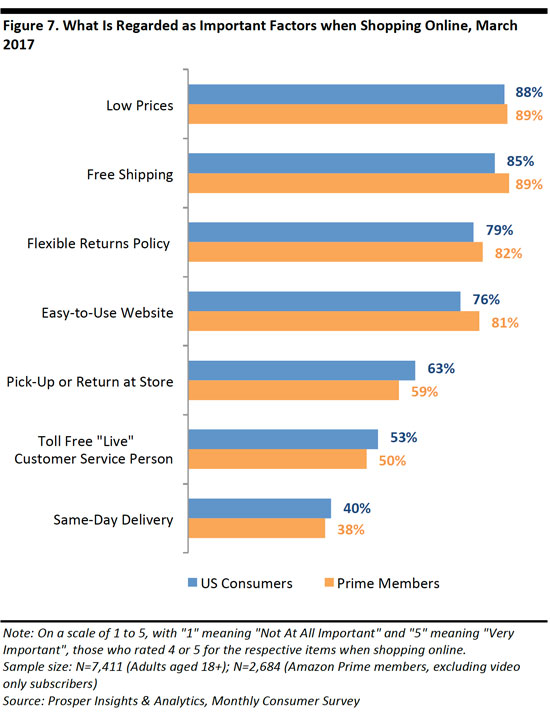

- Low prices and free shipping are the two most important factors for consumers when shopping online, while same-day delivery holds the least importance.

Executive Summary

This is our fifth monthly report based on Prosper Insights and Analytics’ Amazon Shopper Intelligence Service. This month, we focus on Amazon Prime members, comparing their shopping behavior with that of the average US consumer.

Key Findings

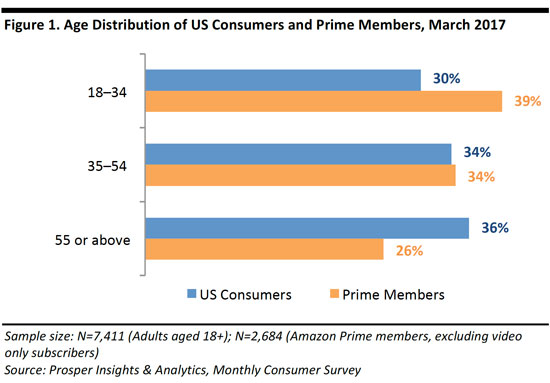

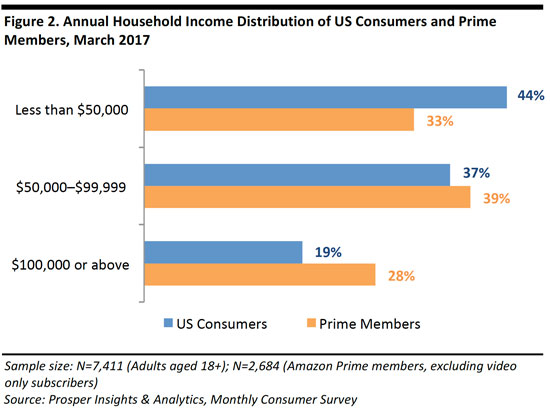

- Prime members are younger and more affluent than US consumers in general. Those aged between 18 and 34 represent 39% of Prime members, higher than US consumers in general at 30%. In terms of income, 28% of Prime members earn an annual household income of $100,000 or above, compared to 19% of US consumers in general.

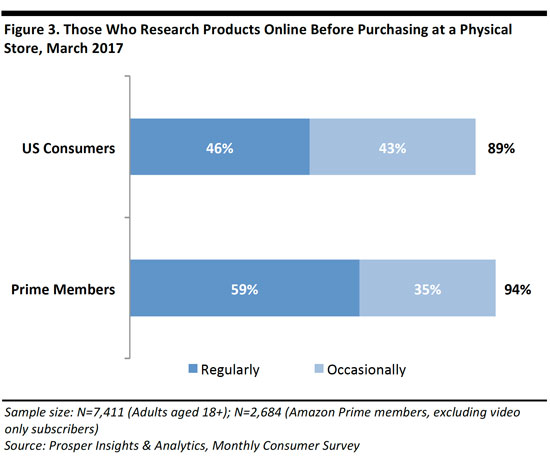

- Prime members are more likely to research products before making a purchase. Some 59% of Prime members do so regularly, compared to 46% of US consumers.

- A higher proportion of Prime members have made a purchase online or on a mobile site. However, this does not imply that brick-and-mortar is less popular among Prime members. Prime members shop offline as often as the average US consumer does.

- Low prices and free shipping are the top-two most-mentioned important factors when shopping online cited by all consumers. Same-day delivery, which comes as a free benefit for Prime members, is the least mentioned factor among both Prime members and US consumers in general.

About Amazon Shopper Intelligence Service

The Amazon Shopper Intelligence Service provides members with monthly data on consumer shopping patterns and preferences, drawing on more than 10 years of data on Amazon shoppers as well as on shoppers at other leading retailers. The data are instructive in helping users make informed business decisions.

1. Prime Members are Younger and More Affluent

Prime members are skewed towards a younger age group. According to the Prosper monthly consumer survey, those aged 18–34 represent 39% of Prime members, compared to 30% of US consumers in general.

Prime members aged 55 and above, which include Boomers and Silvers, are fairly represented at 26%, although this is still lower than US consumers in general at 36%.

Prime members tend to be more affluent as well: 28% of surveyed Prime members earn an annual household income of $100,000 or above, higher than that of US consumers in general at 19%.

2. More than Half of Prime Members Tend to “Research Online, Purchase Offline” Regularly

The vast majority of US consumers, including Prime members, research products online before making a purchase at a physical store—also known as ROPO (Research Online, Purchase Offline).

Prime members tend to research online and purchase offline regularly. In March 2017, 59% of surveyed Prime members indicated they had done so regularly, which is higher than US consumers in general at 46%.

Amazon Has Overtaken Google as the Starting Point for Product Research

In 2012, Amazon and Google were on par as starting gateways for product research. Both sites attracted 25% of US consumers in March 2012, leading other websites by a margin of more than 20%.

By March 2017, Amazon’s mindshare in terms of product research had increased to 34%, while Google’s mindshare had dropped to 20%. Not surprisingly, more Prime members cited Amazon as the starting point for product research, which stood at 45% in March 2017.

3. Prime Members Are Omnichannel Shoppers

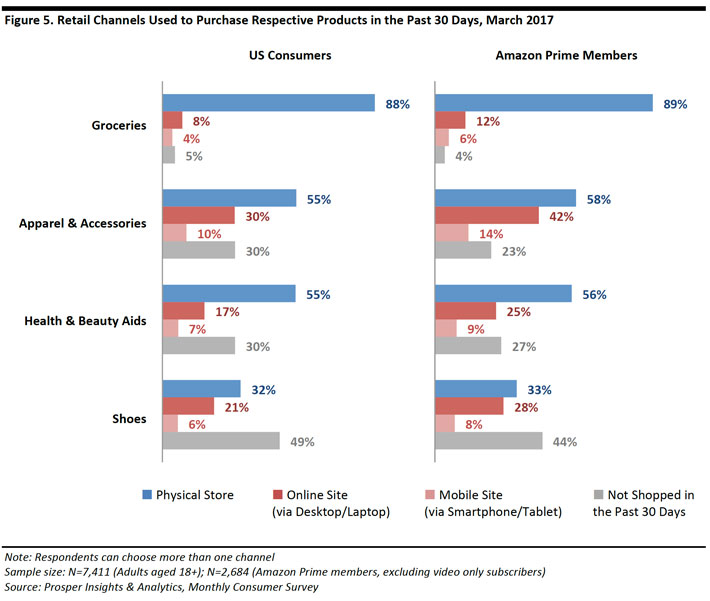

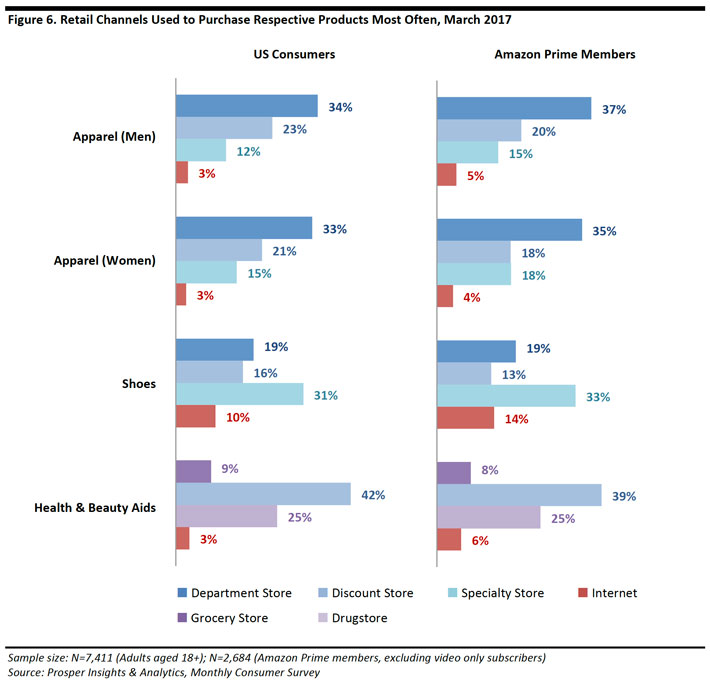

We looked at retail channels used by US consumers and Prime members in March 2017, focusing on four categories including apparel & accessories, groceries, health & beauty aids and shoes.

Naturally, a higher proportion of Prime members had purchased the respective items online or on a mobile site. In March 2017, 42% of surveyed Prime members had purchased apparel online, which is higher than US consumers in general at 30%. The same pattern is observed in other categories as well, for both web and mobile sites.

However, this does not imply that brick-and-mortar is less popular among Prime members. Across the four product categories, roughly the same proportion of Prime members purchased products at physical stores as did US consumers in general. Some 58% of Prime members had purchased apparel at physical stores, which is higher than US consumers in general at 55%.

Prime members are also more active consumers, which correlates with their relevant affluence and younger age.

4. The Majority of Prime Members Shopped Most Often Offline Too

The majority of US consumers, including Prime members, purchased apparel, shoes and health & beauty aids most often at brick-and-mortar locations.

Across the four product categories, more Prime members purchased the respective items the most online, while fewer Prime members made purchases at discount stores when compared with US consumers in general, which again reflects their higher relative affluence.

5. Competitive Pricing Remains the Key Reason to Shop Online

According to the survey, free shipping and low prices are the top-two most-important factors when shopping online, for both Prime members and US consumers in general, indicating that online retailers’ competitive pricing remains the key reason for consumers to shop online.

Free shipping and free same-day delivery are exclusive benefits for Prime members. However, while 89% of surveyed Prime members cited free shipping as an important factor when shopping online, only 38% mentioned “same-day delivery.”

However, with the US online grocery market set to boom, we expect same-day delivery to become more important. Readers can find further analysis of online grocery in our recent report: Online Grocery Series: The US—Market Set To Boom as Basket Sizes Grow.

About the Amazon Shopper Intelligence service

The Amazon Shopper Intelligence Service combines Fung Global Retail & Technology analysis and commentary with input on thousands of US shoppers from Prosper. It includes:

- Over 10 years of data on Amazon shoppers as well as on leading retailers’ shoppers

- Prosper Shopper Preference Share (indicates how Amazon is growing as a preferred retailer for 11 different merchandise categories, and the reasons why)

- Retail positioning maps (plot retailers and their competitors based on the percentage of their shoppers who shop there for particular reasons)

- Net promoter scores

- Key demographics